After Market Data of NSE,BSE and MSEI in Capital Markets For Trade Date 13-Jun-2022 Category Date Buy Value Sell Value Net Value FII/FPI 13-Jun-2022 3,927.38 8,091.39 -4,164.01 DII 13-Jun-2022 6,969.98 4,155.48 2,814.50 FII Derivatives Statistics Type BuyContracts BuyAmt (Rs. Cr) SellContracts SellAmt (Rs. Cr) Open InterestContracts Open InterestAmt (Rs. Cr) Index Futures 49,357 3,945 71,870 Read More

News

After Market Data of NSE,BSE and MSEI in Capital Markets For Trade Date 10-Jun-2022 Category Date Buy Value Sell Value Net Value FII/FPI 10-Jun-2022 4,287.93 8,261.88 -3,973.95 DII 10-Jun-2022 6,105.56 3,274.49 2,831.07 FII Derivatives Statistics Type BuyContracts BuyAmt (Rs. Cr) SellContracts SellAmt (Rs. Cr) Open InterestContracts Open InterestAmt (Rs. Cr) Index Futures 44,088 3,635 64,858 Read More

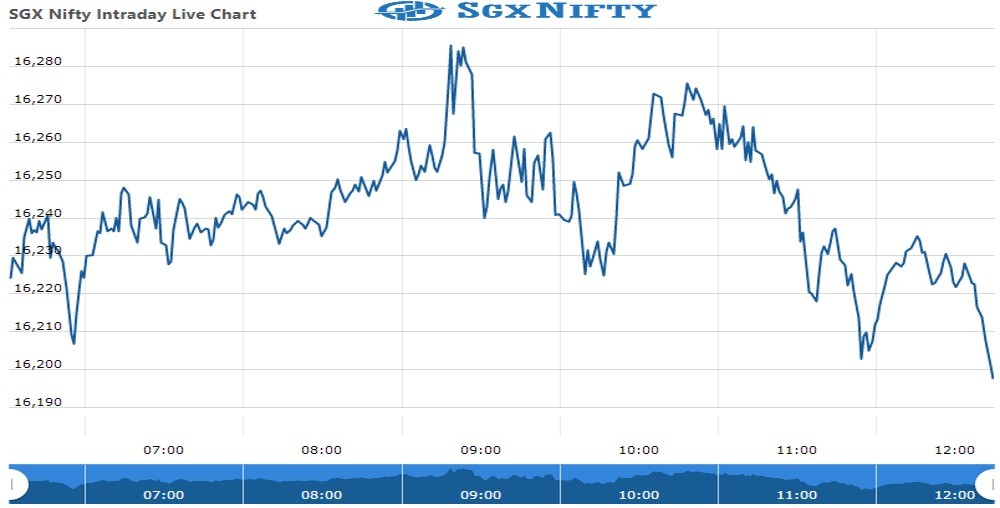

SgxNifty Futures Update : 10 June 2022 The SgxNifty Future is trading at 16,197.50 with a loss of -1.69% or -277.95 point. The Nikkei 225 Future is trading at 27,808.0 with a loss of -1.74% percent or -492.0 point.The Hang Seng Future is trading at 21,550.5 with a loss of –1.37% percent or -298.5 point. TODAY’S FACTORS AND EVENTS OMCs have announced a relief scheme for sugar companies Read More

After Market Data of NSE,BSE and MSEI in Capital Markets For Trade Date 09-Jun-2022 Category Date Buy Value Sell Value Net Value FII/FPI 09-Jun-2022 6,196.55 7,709.19 -1,512.64 DII 09-Jun-2022 5,297.49 3,672.59 1,624.90 FII Derivatives Statistics Type BuyContracts BuyAmt (Rs. Cr) SellContracts SellAmt (Rs. Cr) Open InterestContracts Open InterestAmt (Rs. Cr) Index Futures 39,699 3,318 50,305 Read More

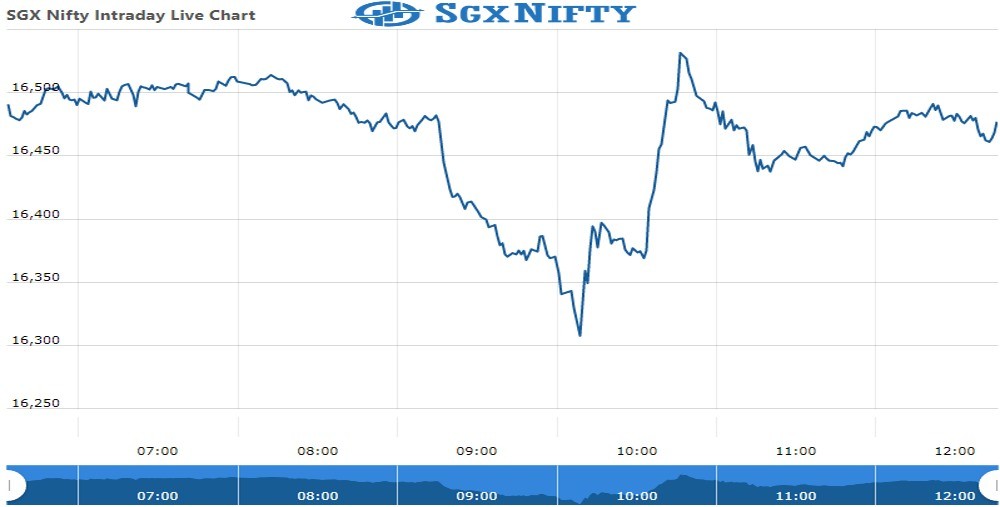

SgxNifty Futures Update : 09 June 2022 The SgxNifty Future is trading at 16,344.0 with a loss of -0.13% or -20.8point. The Nikkei 225 Future is trading at 28,217.5 with +0.10% percent or +27.5 point.The Hang Seng Future is trading at 21,733.0 with a loss of -0.53% percent or -116.0 point. TODAY’S FACTORS AND EVENTS In India, the near-term texture of the market is ‘sell on rallies’. FPI’s sustained selling Read More

After Market Data of NSE,BSE and MSEI in Capital Markets For Trade Date 08-Jun-2022 Category Date Buy Value Sell Value Net Value FII/FPI 08-Jun-2022 5,468.82 7,953.07 -2,484.25 DII 08-Jun-2022 5,508.57 3,604.24 1,904.33 FII Derivatives Statistics Type BuyContracts BuyAmt (Rs. Cr) SellContracts SellAmt (Rs. Cr) Open InterestContracts Open InterestAmt (Rs. Cr) Index Futures 34,726 2,934 43,444 Read More

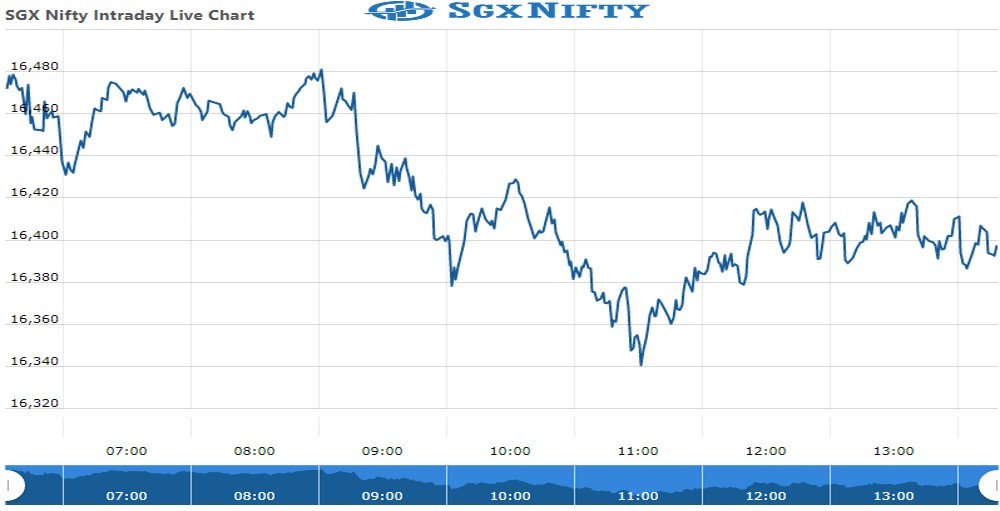

SgxNifty Futures Update : 08 June 2022 The SgxNifty Future is trading at 16,469.8 with +0.25% or +40.5 point. The Nikkei 225 Future is trading at 28,167.5 with +0.56% percent or +157.5 point.The Hang Seng Future is trading at 21,811.5 up with +2.09% percent or +445.5 point. TODAY’S FACTORS AND EVENTS Indian equity benchmarks extended their losing streak to a third day on June 7 amid fears that the Reserve Bank Read More

After Market Data of NSE,BSE and MSEI in Capital Markets For Trade Date 07-Jun-2022 Category Date Buy Value Sell Value Net Value FII/FPI 07-Jun-2022 5,637.32 7,931.30 -2,293.98 DII 07-Jun-2022 5,062.40 3,751.26 1,311.14 FII Derivatives Statistics Type BuyContracts BuyAmt (Rs. Cr) SellContracts SellAmt (Rs. Cr) Open InterestContracts Open InterestAmt (Rs. Cr) Index Futures 46,241 3,903 74,955 Read More

SgxNifty Futures Update : 07 June 2022 The SgxNifty Future is trading at 16,399.5 with a loss of -1.10% or -181.8 point. The Nikkei 225 Future is trading at 27,947.5 with +0.13% percent or +37.5 point.The Hang Seng Future is trading at 21,330.5 with a loss of –1.24% percent or -267.5 point. TODAY’S FACTORS AND EVENTS Indian indices witnessed negative start on Tuesday amid mixed global trends. Globally, US markets closed Read More

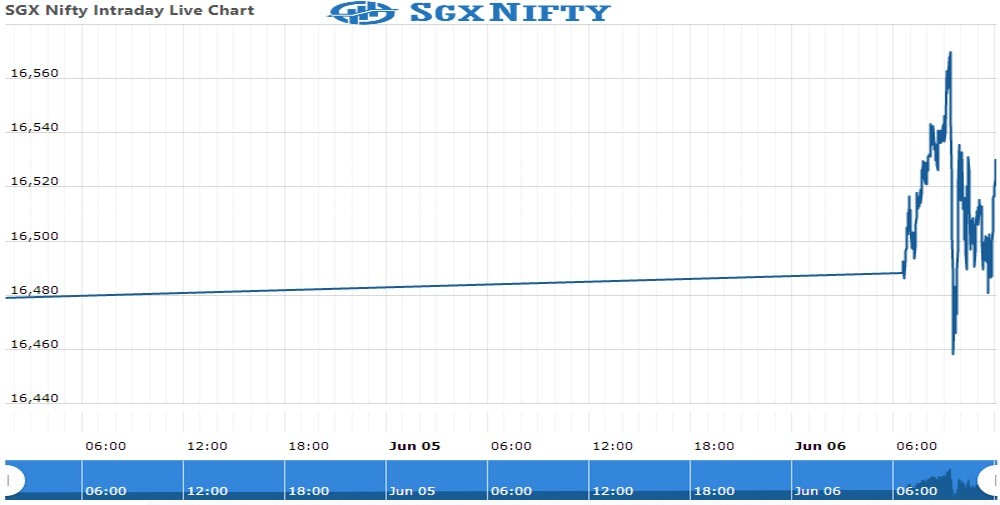

SgxNifty Futures Update : 06 June 2022 The SgxNifty Future is trading at 16,522.50 with a loss of -0.50% or -82.75 point. The Nikkei 225 Future is trading at 27,862.5 with +0.42% percent or +117.5 point.The Hang Seng Future is trading at 21,256.0 with a loss of -0.03% percent or -6.5 point. TODAY’S FACTORS AND EVENTS Despite government’s supply side interventions to curb price pressures, the foreseeable inflation Read More